Decentralized finance (DeFi) has emerged as an alternative to traditional financial services, allowing users to operate in an autonomous ecosystem without intermediaries. Thanks to blockchain technology and economic incentives, DeFi protocols offer a wide variety of services, from stablecoins to insurance and portfolio management. However, the lack of regulation and the presence of legally undefined entities have generated concerns and warnings from different international organizations. In this context, the main challenge for DeFi is to establish feasible and assured regulatory policies that can guarantee the protection of users and the stability of the system.

The Decentralized Economy

The decentralized economy is an ecosystem where financial services are produced through automated protocols supported by a combination of cryptographic solutions and economic incentives to eliminate financial intermediaries. In contrast to traditional financial services, DeFi consists of a set of universally accessible autonomous protocols, which are developed, maintained and used by a set of pseudonymous agents rather than by single entities.

By pseudonymous agent we mean that the agents operate under a set of public, consistent, but non-identifiable addresses, which they generate for free.

Main DeFi services

In the world of decentralized finance (DeFi), there are a number of services that are gaining popularity among users. These services include Stablecoins, Decentralized Exchanges (DEX), Credit, Insurers and Portfolio Management. Each of these services offers an innovative, stand-alone solution to traditional financial challenges, eliminating intermediaries and offering greater transparency and efficiency.

– Stablecoins: Stablecoins are cryptocurrencies whose value is backed by a real asset, such as the US dollar or gold, making them more stable and less volatile than other cryptocurrencies. Stablecoins are a popular way to transfer value in the DeFi space because they allow users to transact without having to worry about fluctuating prices.

– Exchanges (DEX): Decentralized exchanges (DEX) are trading platforms that operate on the blockchain and allow users to exchange tokens without the need for a centralized intermediary. DEXs use Smart Contracts to automate trading processes, allowing for greater transparency and efficiency. DEXs also offer users greater privacy and control over their funds, as transactions are conducted directly between users and not through a third party.

– Credit: Credit services in DeFi are provided by liquidity funds that allow users to borrow digital assets with collateral in other cryptocurrencies. These services are based on Smart Contracts that automate the lending and settlement process, which reduces costs and risks for all parties involved. Credit services in DeFi are also more accessible than traditional lending services, as users can access them without having to go through the typical bank approval and verification processes.

– Insurers: Insurers at DeFi offer coverage services for future, perpetual and synthetic risks. These services are based on Smart Contracts that guarantee indemnity payments in the event of an insured event. DeFi insurers also offer greater transparency and efficiency compared to traditional insurers, as contracts are programmable and claims are processed automatically without the need for intermediaries.

– Portfolio management: Portfolio management in DeFi allows users to create and manage digital asset safes that are governed by pre-defined rules in Smart Contracts. These contracts automate asset management processes, such as buying and selling cryptocurrencies, and allow users to diversify their portfolio efficiently and without the need for a centralized intermediary. Portfolio management in DeFi also offers greater transparency and control over assets, as users can monitor their investments in real time and make informed investment decisions.

DeFi Policy Challenge

In recent years, the rise of DeFi, has been one of the most discussed topics in the world of finance and technology. As this new form of finance has expanded, concerns have also arisen about the risks and consequences that DeFi policies could have on the global economy. As a result, various organizations have published reports and guides aimed at addressing these concerns and proposing regulatory solutions. In this context, it is important to analyse the main reports on the risks and consequences of DeFi and the policies needed to regulate this new financial paradigm:

- IOSCO report (2022)

- World Economic Forum policy toolkit (2021)

- Financial Action Tast Force guidance on DeFi (2021)

- Warnings about DeFi by the IMF (2021), the OECD (2022) y the Financial Stability Board (2022).

- BIS report (2021)

In addition to the complexity of regulating an emerging industry, DeFi presents other significant challenges. One of these is the lack of transparency in transactions and the difficulty in identifying those responsible in the event of fraud or illicit activity. In addition, due to the decentralized nature of DeFi, most users do not have financial expertise or advanced technical knowledge, which increases the risk of asset loss due to human error or cyber-attacks. It is also important to note that some DeFi services, such as decentralized lending and exchanges, are subject to volatility and fluctuations in underlying asset prices, which can result in significant financial losses for users. All of this makes DeFi regulation a major challenge for regulators and financial authorities around the world.

For DeFi regulatory policies to be effective and appropriate, it is important to ensure that they identify the real needs for public intervention in this area. It is not simply a matter of extending traditional economic policy rules and regulations to DeFi, but of understanding the particularities of this ecosystem and the specific needs of users and participants. This implies a careful assessment of potential risks and threats, as well as ways in which regulatory policies can mitigate these risks without unduly constraining innovation and growth in the DeFi space.

In addition, the feasibility of regulatory policies is a key factor to consider. Policies must be feasible and enforceable in practice, taking into account the technical limitations and complexities of DeFi.For example, implementing policies that require identification of DeFi users may be difficult due to the privacy and anonymity inherent in blockchain technology. Therefore, regulatory policies should be designed with both effectiveness and feasibility in mind.

DeFi Contributions

DeFi can help streamline the need to adapt traditional policy frameworks by enabling the elimination of unnecessary intermediaries and the automation of financial processes through the use of blockchain technology and smart contracts. This can lead to greater efficiency and transparency in financial transactions, reduce costs, and improve access to financial services for people currently underserved by the traditional financial system.

In the traditional economy, financial intermediaries such as banks and brokers act as middlemen to mitigate friction and reduce risk in financial transactions. However, in the case of DeFi, traditional intermediaries are eliminated and replaced with autonomous protocols and smart contracts, allowing for greater efficiency and transparency in asset management. Through automation and decentralization, DeFi is expected to offer more cost-effective and fairer solutions compared to traditional finance. In addition, by allowing users to have greater control over their assets and transactions, DeFi is expected to foster greater financial inclusion and economic empowerment.

However, while DeFi has the potential to improve financial access and inclusion, it also presents challenges and risks, such as lack of regulation, price volatility, and the possibility of illicit activities. Therefore, it is important that regulatory policies are tailored to the characteristics and limitations of DeFi to maximize their benefits and minimize risks.

Information at DeFi

The concept of contracting space refers to the set of inputs or information needed to draft a contract.

In traditional systems, this information is observable and verifiable, and in case of a legal dispute, it can be evaluated by a court. In contrast, in DeFi systems, the execution of Smart Contracts is objective, automated, final and free from any central authority. This means that the information required for contract execution must be publicly verifiable and immediately accessible at the time of execution. Smart Contracts in DeFi eliminate the need for intermediaries and offer greater transparency and efficiency in the execution of financial contracts. However, they also pose regulatory and legal challenges due to the decentralized and autonomous nature of the platform.

Binary information structure

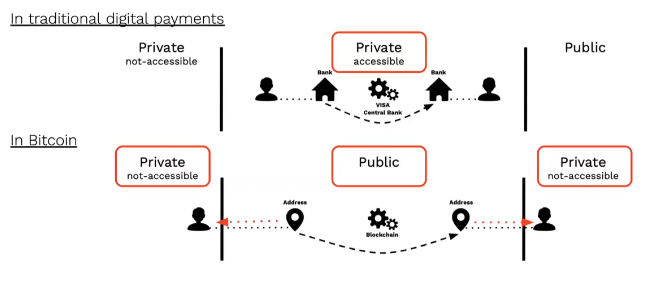

Binary information structure refers to how information is stored and accessed in DeFi systems. In this context, information can be public and verifiable in the ledger or private and unverifiable outside the ledger.

In public information, reference is made to the transparency of transactions. This means that anyone can see the transaction information in the ledger, which allows for greater trust and transparency in the system. This information is practically zero cost to verify, which means that anyone can access it at no cost.

On the other hand, private information refers to pseudo-anonymity, which is information related to the identity of contract participants that is not accessible to the public. This means that information about the identity of the parties involved in the transaction is not public and can only be accessed by those who have permissions and access to do so. However, verifying private information is infinitely expensive, which means that it can only be accessed by those who can afford the process. This binary information structure allows a balance between privacy and transparency in DeFi systems.

Digital payments

Digital payments have significantly changed the way business transactions are conducted around the world. One of the main challenges facing digital payment systems is the privacy of information in the transaction. “Key friction” refers to the value of information privacy in a transaction, meaning that there is a sticking point between the need to maintain information privacy and the need to make the transaction verifiable and trustworthy. Traditional payment systems and networks such as Bitcoin propose different solutions:

In traditional payment systems, private and conditionally accessible information is used to protect privacy and security, but this also limits verifiability and transparency. This has the advantage of liability for the parties in case of breach of contract and the possibility of mediated dispute resolution, it also has the disadvantage of a centralized market and lack of innovation.

On the other hand, Bitcoin has proposed a different solution by making transaction information public, which increases verifiability and transparency, but reduces privacy and the ability to control the information. While residual information is not accessible, competition has forced down the cost of services and there are incentives to innovate. However, it also has disadvantages, such as the lack of mediated conflict resolution, the impossibility of accessing private information and the inability to identify individuals.

Taxonomy of a DeFi protocol

The taxonomy of a DeFi protocol refers to the classification of financial services that can be provided through the blockchain network. In this regard, three categories have been identified: autarkic, cross-chain and off-chain.

Autarkic protocols are those that only rely on information within the blockchain network to operate. This means that only transactions can be made using the network’s native tokens and that they do not require any additional information to operate. In this sense, they are a completely decentralized solution that does not rely on any third party to operate. These protocols are very useful to ensure security and transparency in financial transactions, since being fully integrated into the blockchain network, all transactions are immutably and transparently recorded. In addition, since they do not require the intervention of third parties, they are also faster and more efficient in processing transactions, as there are no delays or bottlenecks due to the intervention of intermediaries.

Examples of autarkic protocols are decentralized exchanges (DEX) such as Uniswap, where only tokens can be exchanged within the Ethereum network, or lending protocols such as Compound, where loans and collateral can only be made with tokens native to the network.

Cross-protocols, on the other hand, rely on both on-network and off-network information. That is, token exchanges can take place on the network, but real assets or collateral are needed to support financial services, such as stable coins or collateral loans. These protocols enable the transfer of value and other financial services that require additional information, such as identity verification, collateral valuation, and access to external liquidity sources.

For example, a cross-protocol could enable the exchange of tokens between different blockchains or the creation of stablecoins backed by assets external to the blockchain network. Unlike autarkic protocols, cross-protocols have greater flexibility and the ability to offer more complex financial services. However, they may also be more vulnerable to errors or bad practices in the handling of information external to the blockchain network.

Finally, off-chain protocols rely solely on unverifiable information outside the network, which limits the ability to verify information. These protocols usually involve human counterparties or entities external to the network, and therefore, the information they handle cannot be automatically verified by the blockchain.

For example, off-chain protocols may involve agreements between two parties outside the blockchain network, such as collateralized loan contracts in which a value is established for an asset not native to the network. They can also include stablecoins that are backed by real assets held outside the blockchain network. Off-chain protocols can increase the capacity and functionality of blockchain networks by enabling a wider variety of financial services and greater flexibility in contract terms. However, they may also present greater risks of fraud or breach of contract due to the lack of automatic verification of information.

As more services external to the blockchain network are used, there is a gain in variety of financial services and contracting space, but the ability to verify information is lost, which poses a risk in terms of transparency and financial security.

Implementable policy proposals

As the decentralized finance (DeFi) ecosystem continues to grow and mature, the need for clear regulations and policies that promote innovation and protect users is becoming increasingly apparent. In this regard, various proposals have emerged with the aim of addressing these challenges. The following are some of the implementable policies that have been proposed to regulate DeFi activity and promote its sustainable development.

1. Regulating DeFi activity of legal entities under public mandates.

One proposal to regulate DeFi activities would be to establish public mandates that require legal entities operating in this space to comply with certain requirements. This would include implementation of security measures, compliance with relevant laws and regulations, protection of user rights, and accurate and transparent financial reporting. Regulators could also require these entities to demonstrate that they have the necessary resources to comply with these requirements.

2. Voluntary compliance frameworks.

Another proposal could be the creation of voluntary compliance frameworks for DeFi entities to adhere to certain standard practices. These frameworks could be developed by the industry and agreed upon by regulators and DeFi entities. These frameworks could include security, privacy and transparency standards, and could be verified by independent third parties.

3. Public observatory: public procedural oversight.

One proposal for overseeing DeFi activities would be the creation of a public observatory to monitor procedures and transactions in real time. The observatory could be managed by regulators and industry members and could provide information on transactions taking place in the DeFi space. This would help regulators identify and address potential illegal activities and could also help users make informed decisions.

4. Oversight, regulation and support of oracle markets.

Oracles markets are a fundamental part of the DeFi infrastructure and are used to provide external information to smart contracts. One proposal would be to monitor and regulate these markets to ensure that the information provided is accurate and verifiable. Regulators could also provide support to these markets to encourage their development and improve the quality of information provided.

Conclusions

The adoption of DeFi has led to a new understanding of the nature of financial services and how information plays a crucial role in managing risks and rewards. Traditional financial intermediaries have relied on centralization of information and reliance on trust in third parties. However, blockchain technology has enabled the creation of decentralized financial systems that eliminate the need for intermediaries and make information public and accessible to all participants.

In this sense, the implementation of DeFi has led to a significant change in the structure of information used in financial services. The transparency and verifiability of financial transactions through blockchain technology have enabled the creation of new financial protocols and contracts that are more efficient and secure than traditional systems.

However, the implementation of DeFi also presents challenges in terms of regulation and oversight. As decentralized financial services continue to evolve, there is a need to develop policies and regulatory frameworks that enable the sustainable and responsible growth of DeFi. These policies must be implementable and take into account user needs and technological constraints.

This article provides an insightful overview of the transformative potential of DeFi! It’s exciting to see how blockchain technology is revolutionizing traditional financial services, offering greater efficiency, transparency, and accessibility.