In recent years, the world of decentralized applications (DApps) has experienced a boom in technology. These applications, which operate without the need for a centralized intermediary, offer a number of advantages in terms of transparency, security, and privacy. However, one of the main barriers to their mass adoption remains the lack of clarity regarding their legal structuring and the raising of capital by companies. In this context, the company Legal Nodes has offered a conference on how to structure ownerless and permissionless DApps while attracting corporate investment. In this article, we will explore the main recommendations and strategies put forward at this conference to help DApp developers address these legal and financial challenges.

Web2 and Web3

Web2 is a way of referring to the evolution of the Web from its original conception to its current state, which emphasizes user interaction and collaboration in the creation and distribution of content. In general terms, Web 2 is characterized by greater interactivity, personalization, and accessibility of content, as well as the use of tools and technologies that enable the creation of online communities and real-time collaboration. Examples of Web 2 platforms are social networks, blogs, forums, wikis and online file storage and sharing services.

Web3 is a new generation of Internet technology that focuses on decentralization and transparency. Instead of relying on centralized intermediaries, Web3 uses technologies such as blockchain to allow users to interact directly with each other, without the need for a centralized intermediary. This means that data and transactions are more secure, private and resistant to censorship and manipulation. Web 3 also offers greater autonomy and control for users, allowing them to own and control their own data and digital assets. Examples of Web 3 applications include cryptocurrencies, smart contracts, decentralized applications (DApps) and autonomous digital identity systems.

The main difference between Web2 and Web3 lies in the infrastructure on which they are based. While Web2 is based on centralized infrastructures owned by a single entity, Web3 is based on decentralized infrastructures whose ownership and management are distributed among multiple entities.

This difference has significant implications from a legal point of view. In Web2, regulation and enforcement are relatively straightforward, since the Website and its infrastructure are under the ownership and control of a single entity that can be regulated in the country where it is located. In Web3, this is not so straightforward, as decentralized applications are hosted on multiple nodes distributed around the world, which makes compliance with laws and regulations much more complex.

Another important aspect is that Web3 is built on technologies such as blockchain, which offer greater transparency, security, and privacy. This allows decentralized applications to be more resistant to malicious attacks, as well as to manipulation and censorship.

Ultimately, Web3 represents a technological revolution that is transforming the way we interact with technology, and its impact on the legal and regulatory world is yet to be fully seen.

On-chain and Off-chain parts of a DApp

In the context of decentralized applications (DApps), it is common to talk about the On-chain and Off-chain parts of the application.

The On-chain part of a DApp refers to all transactions and interactions that occur directly on the blockchain, i.e., on the public, decentralized ledger used by the DApp. These transactions are executed autonomously and without the need for intermediaries, and are immutable and irreversible once they have been recorded on the blockchain. Examples of On-chain transactions include the transfer of cryptocurrencies, the execution of smart contracts and digital identity verification.

Common On-chain elements include the following:

- DeFi (Decentralized Finance): These are applications that allow users to access financial services without the need for centralized intermediaries, such as banks. Examples of DeFi services include lending, cryptocurrency exchange and interest generation.

- NFTs market: NFTs (Non-Fungible Tokens) are unique and indivisible digital assets that are used to represent works of art, music, videos and other assets. NFTs marketplaces allow users to buy, sell and trade these unique digital assets.

- Tokenization: Tokenization is the process of converting a real asset into a digital asset. This allows users to trade physical assets (such as real estate or vehicles) more efficiently and transparently.

- Treasury: Treasury is an important part of many DAOs. It refers to the pool of funds and digital assets that are controlled and managed by the DAO to finance its development and growth.

- Voting in DAOs: DAOs are autonomous, decentralized organizations that employ smart contracts to make crucial decisions. Voting in DAOs is a considerable element of the governance of these organizations, allowing DAO members to vote on relevant issues, such as code or treasury changes.

On the other hand, the Off-chain part of a DApp refers to all interactions that occur outside the blockchain, in the physical world or in other computer networks. This part includes interfaces that enable interaction between the DApp and the real world, such as mobile applications, websites and traditional payment systems. Off-chain interactions may be necessary to provide additional information to the DApp, such as sensor data or verified identity information, or to perform transactions involving non-digital assets, such as real estate or vehicles.

Common off-chain elements include:

- Software development team: DApp development requires a team of developers specializing in blockchain and cryptocurrencies to work on implementing and updating the application.

- Technical support: Like any other application, DApps also need technical support to resolve technical issues and ensure the stability of the application.

- Fundraising: DApps often need to raise funds to finance their development and growth. This may include crowdfunding campaigns or selling DApp tokens to interested investors.

- Membership of DAOs: DAOs may also have a membership that allows users to participate in the governance of the organization and make important decisions about its future.

- Insurers: Insurers can also be Off-chain elements of DApps, as they can provide protection against specific risks, such as loss of digital assets or breach of smart contracts.

Governance of a DApp is another relevant aspect to consider, as it refers to who has the ability to make changes and access the application’s information. Governance can be centralized or decentralized, and can significantly affect the security, transparency, and adaptability of the DApp as it evolves over time. In a decentralized DApp, governance is typically more distributed and autonomous, with users and developers participating in making significant decisions about the future of the application.

Companies of a Dapp

In the world of decentralized applications, known as DApps, a seamless connection between the virtual world and the real world is required. To achieve this, three types of specialized companies are needed to function as a bridge between the on-chain and off-chain elements of the platform. These are: the software development company, the token company and the DAO company. Each plays a crucial role in the creation and operation of a DApp, and in this article we will explore in detail what each of these companies do and why they are essential to the success of a DApp.

The Developer Company, also known as the software development company, is the heart of the DApp. It is responsible for building, maintaining and updating the software that runs on the blockchain and in the off-chain world. This includes programming the smart contracts, designing and implementing the user interface, and integrating the DApp with other platforms and services.

The intellectual property of the application, including the source code, design, databases and other assets, belong to the Developer Company. This means that they have full control over the evolution of the application and can make decisions about its future development and updates.

On the other hand, the Token Company is essential for the creation and management of the DApp economy. Its main function is to tokenize the DApp’s assets and distribute the tokens to investors. This may include the creation of a native DApp cryptocurrency or the tokenization of existing assets such as real estate or artwork.

The Token Company is also responsible for fundraising for the DApp. This may include organizing an initial coin offering (ICO) or a private token sale. In addition, the Token Company develops long-term funding strategies to ensure the sustainability of the DApp and its economics.

Finally, the DAO Company is crucial for the implementation of decentralized governance in the DApp. Its main function is to create and manage the decentralized organization that governs the DApp. This includes creating rules and protocols for membership, managing voting, and implementing the governance model.

The DAO Company ensures that the DApp has a transparent and democratic governance model, where all members of the community have a voice and a vote in important decisions. This may include decision-making on the future development of the DApp, resource allocation, and conflict resolution. In short, all three companies are essential to the success and sustainability of a DApp in the blockchain ecosystem.

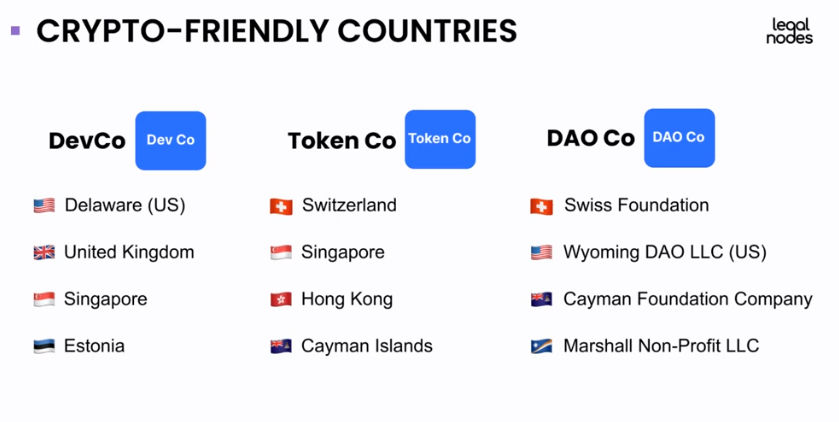

Crypto-friendly countries

Each type of company has specific legal and regulatory requirements, so some countries may be more favorable than others depending on the needs of the company. The following are the most favorable countries to register crypto-friendly companies for each type of company:

Developer Company:

- Delaware, USA: is one of the friendliest states for company formation, as it has extensive legal protection for shareholders and offers great flexibility in terms of company management and structure.

- United Kingdom: has a strong and stable business environment, with clear and transparent regulation for technology companies.

- Singapore: is a country that has excelled in creating a favorable environment for innovation and technology. It has clear and transparent regulation for technology companies, in addition to an advanced technological infrastructure.

- Estonia: is one of the most innovative countries in terms of technology and has a very fast and easy company registration process. It is also known to be a leader in the field of blockchain technology.

Token Company:

- Switzerland: is one of the friendliest countries for cryptocurrency and blockchain startups, with clear regulations and a strong business environment. It is also known for having an advanced and well-established banking system.

- Singapore: is a country that has been proactive in creating a favorable environment for cryptocurrency companies, with clear and transparent regulations and an advanced technological infrastructure.

- Hong Kong: is a global financial center with clear and stable regulations for cryptocurrency and blockchain companies. It also has an advanced technological infrastructure and a wide network of investors and related companies.

- Cayman Islands: is a British overseas territory that offers a favorable business environment for cryptocurrency and blockchain companies, with clear and transparent regulations and a favorable tax structure.

DAO Company:

- Swiss Foundation: Switzerland is a country known to be very friendly to cryptocurrency and blockchain companies. Setting up a Swiss foundation is a popular option for DAOs as it offers a clear and transparent structure for the organization and favorable regulation.

- Wyoming DAO, USA: Wyoming is one of the friendliest states for cryptocurrency and blockchain companies, and recently passed laws allowing the creation of DAOs. Wyoming’s laws provide a clear and flexible structure for DAOs and favorable regulation.

- Cayman Islands Foundation: the Cayman Islands is a British overseas territory that offers a favorable business environment for cryptocurrency and blockchain companies, including the creation of foundations for DAOs.

- Marshall Islands LLC: The Marshall Islands is an independent state with favorable regulation for cryptocurrency and blockchain companies. Setting up an LLC in the Marshall Islands is a popular option for DAOs, as it offers a clear and flexible structure for the organization and favorable regulation.